The 6-Minute Rule for SBA increases COVID-19 EIDL cap to $2 million - Vermont

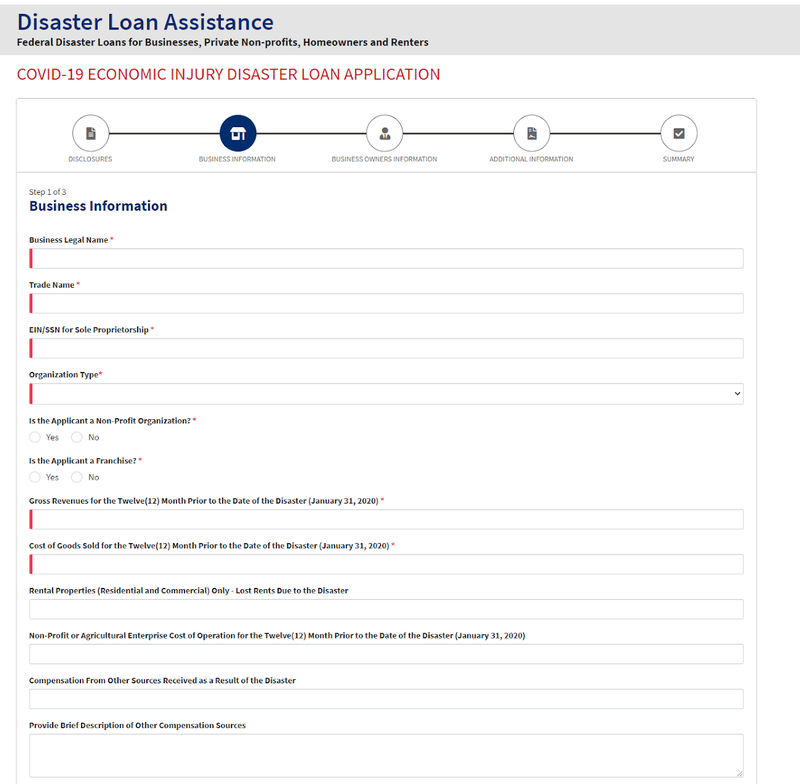

Organization Info This area is the longest and requires your earnings declaration since Jan. 31, 2020. It is essential to keep in mind that not all responses are needed. Sections marked with a red star needs to be completed. If not so significant, just fill them out if they use to your service.

If owned by people, you require to offer information on each owner who has a 20% stake in business or more. Answers Shown Here requested will include: Home address, Telephone number, Social Security number, Date and location of birth, Citizenship status Additional Info This area consists of questions about criminal charges against any owners, then continues to submission of the application.

See This Report about EIDL Program Loans - Mid Penn Bank

The application can be discovered on the SBA Catastrophe Loan Help webpage. The SBA has actually extended the application due date to Dec. 31, 2021. Do not puzzle the new Targeted EIDL Advance with the previous EIDL Advance, which is no longer available. You can not apply for the Targeted EIDL Advance. If you qualify, the SBA will contact you.

The Targeted EIDL Advance was signed into law Dec. 27, 2020, as part of the Consolidated Appropriations Act (CAA), 2021 and supplies targeted "organizations found in low-income neighborhoods with additional funds to guarantee small company continuity, adjustment, and resiliency." This program supplies approximately $10,000 in forgivable financing to previous EIDL applicants who: Are located in a low-income community as defined by area 45D(e) of the Internal Earnings Code; and, Can demonstrate a more than 30% decrease in earnings during an eight-week duration starting on March 2, 2020, or later; and, Formerly received an EIDL Advance for less than $10,000 If you satisfy all of the credentials above and: Received no advance due to absence of available funding; and, Have 300 or less staff members You might likewise be eligible for the Targeted EIDL Advance.